The adjustment of employee benefits is related to Act No. 349/2023 published in the Collection of Laws on 12 December 2023. Here you can take a look at a summary of the main changes in tax and related areas.

EDENRED BENEFIT STANDARD (CARD WITHOUT CAFETERIA)

HARD LIMIT

• Monitoring the limit of CZK 21,983 at the level of charging funds by the employer. The solution is currently under development.

• Card balances from last year do not reduce the limit this year.

Example: The user had CZK 3,000 on the card from last year, and the employer charges the employee CZK 20,000 in January. The top-up will be fine, as it is below the limit of CZK 21,983. The user can thus pay up to CZK 23,000. The next top-up can only be up to CZK 1,983 in the same year.

SOFT LIMIT

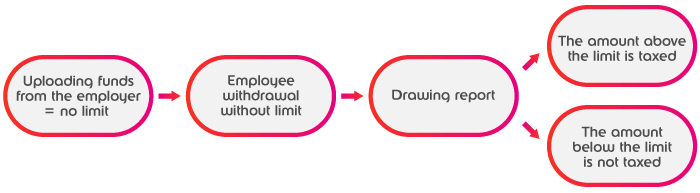

• The user can draw even above the statutory limit of CZK 21,983.

• In the administrative interface of the cafeteria, it is possible to download reports on the monthly basis.